Reimagining Trade Finance: A UX Journey in the Banking Sector

A web portal that could digitize and streamline the entire documentation process involved in trade finance.

Role

UI/UX Designer, UI Developer

Team

Nikhil Mohan (Me),

Ayyappan G (UX Lead),

Vishnu Prasad (Business Analyst),

Praveen P (Project Manager)

Timeline

June 2024 - Present

Project Type

FinTech

Dev Handoff

Web Design

Prototyping

The Backdrop

In the world of international trade, banks serve as the backbone - validating documents, facilitating transactions, and ensuring smooth financial operations across borders. But surprisingly, in many banks, especially in India, these operations still depend heavily on manual paperwork, making the process slow, error-prone, and resource-intensive. That’s where our team stepped in.

Our mission: To design a Trade Finance Application for banks—a web portal that could digitize and streamline the entire documentation process involved in trade finance. The product had to be powerful, scalable, and intuitive for both banks and corporate users.

The Problem

Trade finance involves complex documentation—Letters of Credit, Bill of Lading, Shipping documents, etc.—that must be shared, validated, and approved between importers, exporters, and their respective banks. Previously, all this was handled through manual paperwork, resulting in:

Delayed transactions

Increased manpower

Lack of traceability

Tedious document verification

The challenge was to build A Digital platform that replicates this offline flow while making it faster, secure, and user-friendly, with AI-powered automation to reduce manual effort.

My Role

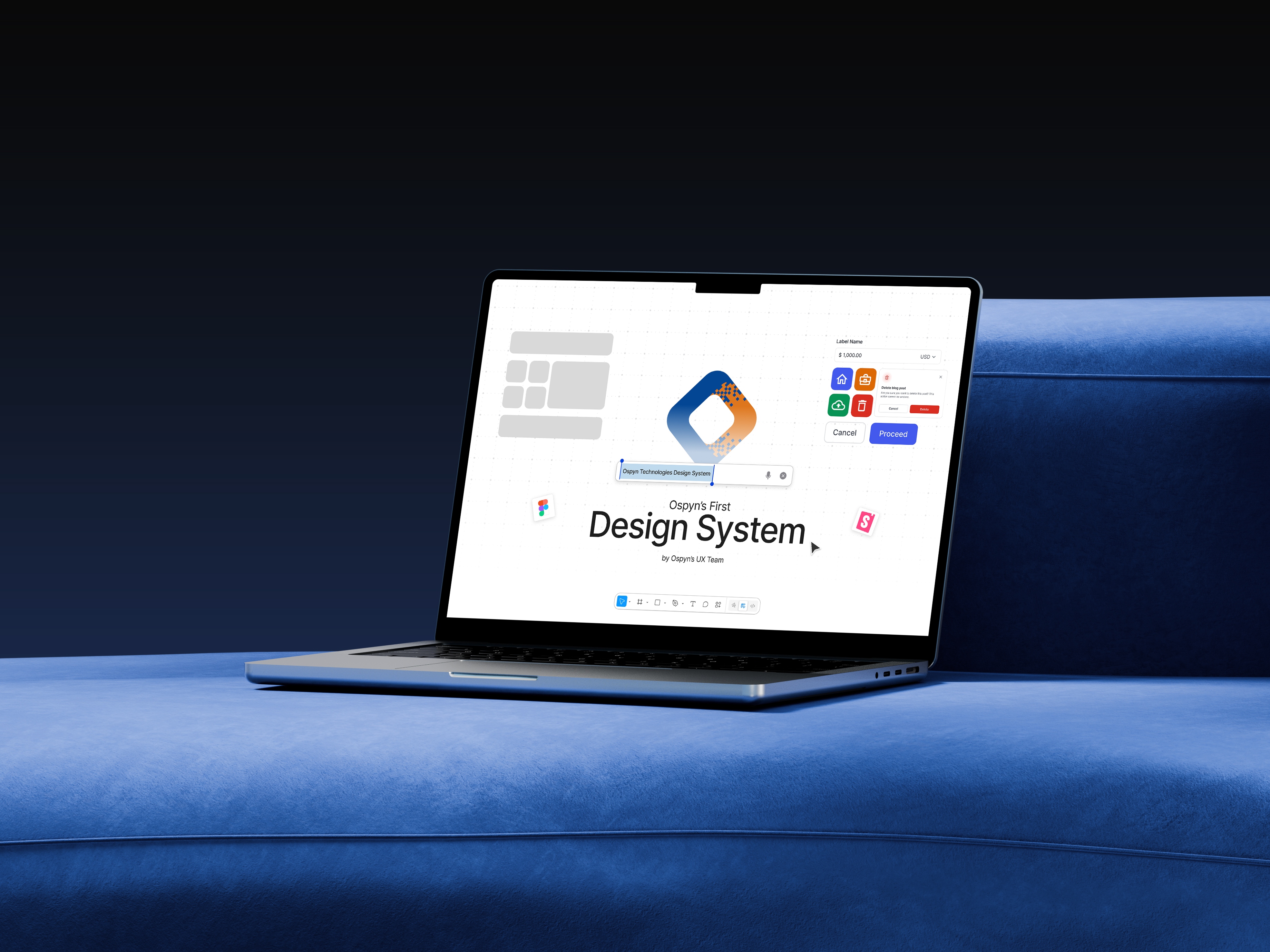

As the UX Designer, I led the initiative to reimagine the Trade Finance application. I collaborated with cross-functional teams (Project Manager, Business Analysts, and Developers), facilitated requirement discussions, created design systems, and crafted wireframes and prototypes for the application’s overhaul.

Design Approach

Empathize

Gathered insights through direct discussions with internal users and banking staff.

Define

Identified core problems and pain points affecting the current workflow.

Design

Created low to high-fidelity wireframes and interactive prototypes in Figma.

Refine

Validated flows with stakeholders and made improvements based on feedback.

User Persona

“We get so many manual requests, it’s tiring and error-prone.”

Adithyan M

Support Team Member

“Sometimes I waste hours just trying to find the right document among hundreds.”

Nazrin A

Operations Staff, Trade Finance Department

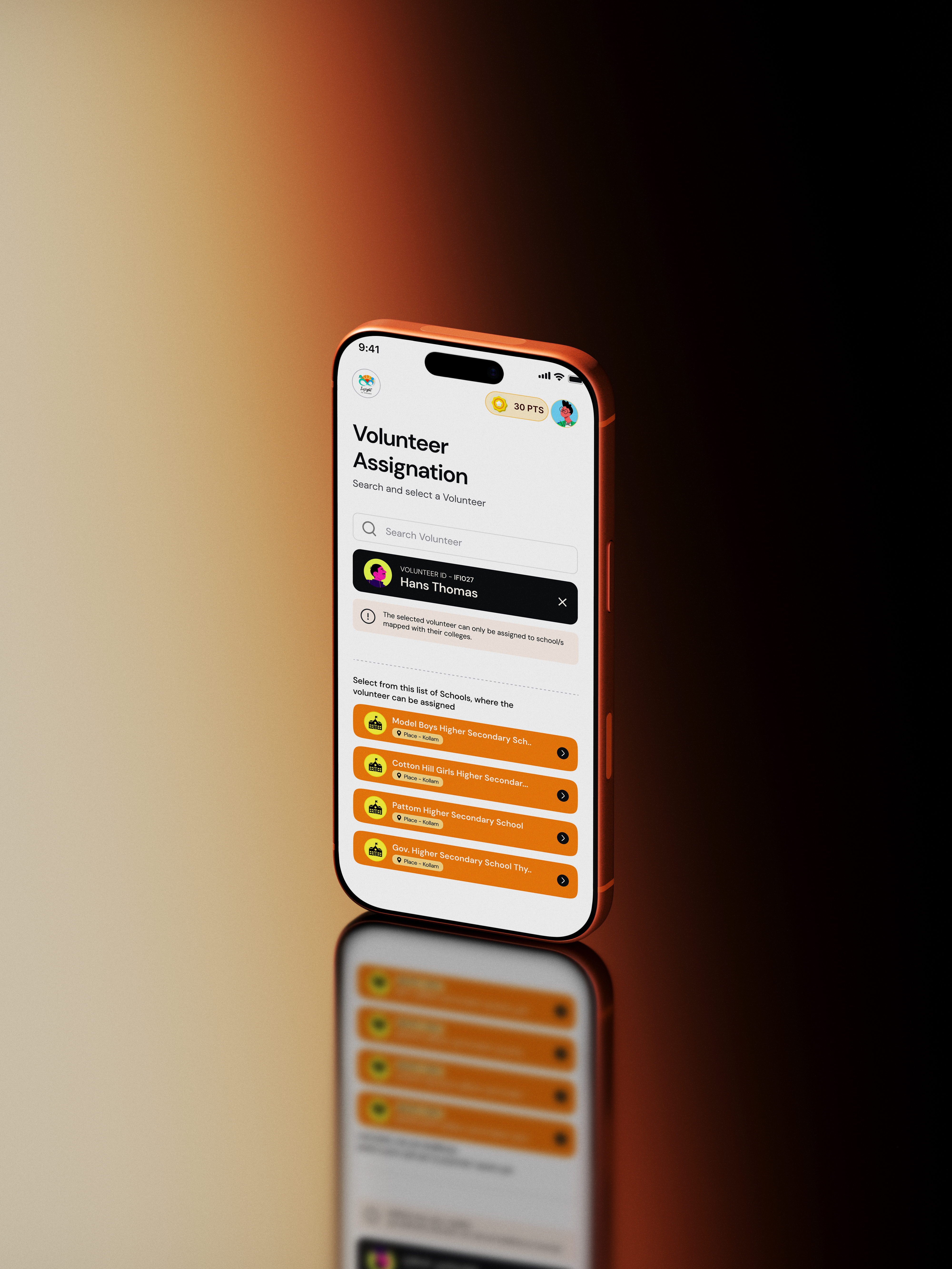

Solution Overview (Abstracted Wireframes)

To protect sensitive business information, these wireframes have been recreated with placeholder content and anonymized data while retaining the overall structure and interaction flow.

Key Design Features:

Compact data presentation — large datasets shown without overwhelming the user.

Sticky filters and sort options — speed up record search.

Clear status indicators — quick visual cues for open, closed, or pending items.

Hybrid input mode — AI auto-fills fields from PDF extraction to reduce manual effort.

Editable fields for flexibility — users can adjust or correct fetched data.

Validation indicators — ensure data accuracy before submission.

Focused task environment — shows only relevant bill details without leaving the page.

Selectable records — users can act on multiple items at once.

Action-oriented CTAs — “Proceed to Pay” and “Cancel” placed for quick decision-making.

Impacts We Created

2x faster document classification and access

Redesigned dashboards and filters helped users quickly identify and act on pending tasks.

50% reduction in manual data entry tasks

Lesser reliance on support staff for verification; process now managed by fewer people.

75% improvement in design-to-development communication.

Clear documentation + frontend support (HTML, CSS, Next.js) + Figma components reduced confusion and rework.

Real-time alerts and milestone tracking improved compliance

Automated reminders for LC/BG expiry and payment deadlines reduced missed actions and penalty risks.

End-to-end customer view in a single dashboard

360° customer profile consolidated all transaction, LC/BG, and compliance data — cutting navigation time between systems by over 70%.

AI-driven document processing reduced turnaround time by 85%

Document classification and data extraction that once took an hour now completes in minutes, with minimal manual corrections.

Reflections & Learnings

- Banking UX demands clarity, hierarchy, and minimalism

- Cross-functional collaboration is key when dealing with high-stake industries

What’s Next

We plan to:

- Conduct more in-depth usability tests with diverse banking professionals to uncover hidden workflow pain points.

- Scale the redesigned experience into mobile platforms, ensuring accessibility for users on the go.

- Integrate AI-driven Assistance like Predictive Insights and automation to simplify repetitive trade finance tasks for users.